How to Invest in Real Estate

How to Invest in Real Estate can be an exciting and lucrative venture, but it also requires careful planning and informed decision-making.

Invest in real estate is a powerful wealth-building strategy that has been used for centuries. It offers the potential for generating passive income, building equity, and achieving long-term financial stability. Whether you're a seasoned investor or a newcomer to the world of real estate, this guide will walk you through the essential steps and considerations to help you navigate the complex landscape of real estate investment.

How to Invest in Real Estate

Invest in real estate can be an exciting and lucrative venture, but it also requires careful planning and informed decision-making. Whether you're a first-time investor or looking to expand your existing portfolio, understanding the intricacies of real estate investment is crucial. This comprehensive guide will walk you through the essential steps, strategies, and considerations to help you navigate the world of real estate investment and make informed choices that align with your financial goals.

Understanding the Basics of Real Estate Investment

Defining Real Estate Investment

Real estate investment involves purchasing properties with the intention of generating income or achieving capital appreciation. Properties can range from residential homes and apartments to commercial spaces and industrial buildings. This investment strategy is grounded in the concept that real estate values tend to appreciate over time, making it a potential avenue for long-term wealth accumulation.

Types of Real Estate Properties

Real estate offers a diverse range of investment opportunities, each with its own set of benefits and considerations. Residential properties, such as single-family homes and condos, are popular choices for beginner investors. Commercial properties, including office spaces, retail centers, and warehouses, cater to a different market segment. Additionally, there are specialized options like vacation rentals, multifamily properties, and Invest in Real Estate development projects.

Benefits and Risks of Real Estate Investment

Real estate investment offers several advantages, such as:

- Steady Income: Rental properties can provide a consistent stream of rental income, which can be particularly beneficial for passive investors.

- Appreciation: Over time, real estate properties tend to appreciate in value, potentially leading to substantial gains when selling.

- Tax Benefits: Real estate investors can leverage tax deductions, including mortgage interest, property taxes, and depreciation.

- Diversification: Real estate can diversify your investment portfolio and provide a hedge against stock market volatility.

However, there are risks to consider:

- Market Fluctuations: Real estate values can be influenced by economic factors and market trends, leading to fluctuations in property values.

- Ongoing Expenses: Property ownership comes with maintenance, repairs, and other ongoing costs that need to be factored into your budget.

- Tenant Risks: Rental properties carry the risk of vacancies, non-payment of rent, and property damage by tenants.

Setting Clear Investment Goals and Strategies

Identifying Your Financial Objectives

Before you start investing, define your financial goals. Are you looking for regular rental income, long-term appreciation, or a combination of both? Understanding your objectives will help shape your investment strategy.

Choosing a Real Estate Investment Strategy

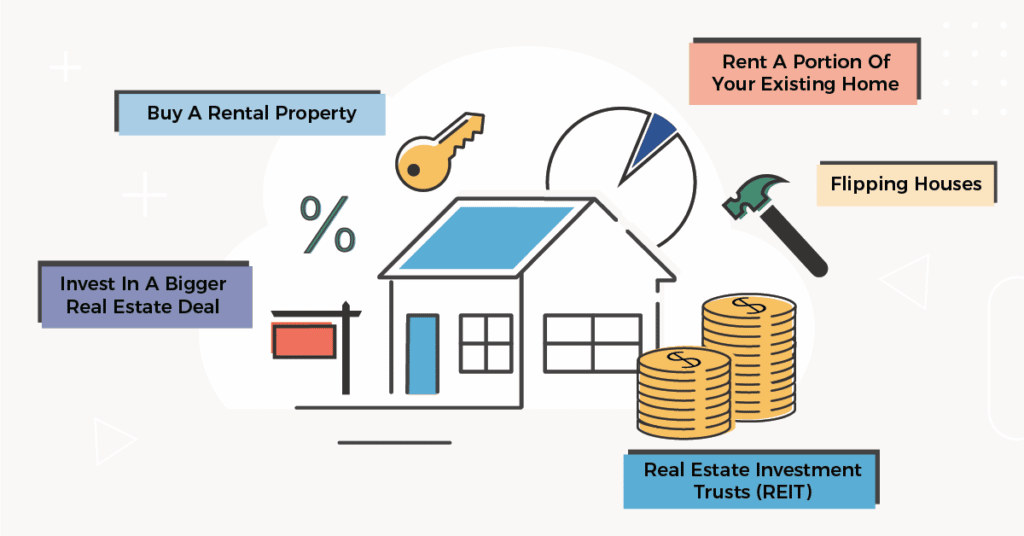

Real estate investment strategies include:

- Buy and Hold: Acquiring properties for rental income and long-term appreciation.

- Fix and Flip: Purchasing properties, renovating them, and selling for a profit.

- Wholesaling: Contracting properties at a discount and assigning the contract to another investor.

- REITs and Crowdfunding: Investing in real estate through platforms that pool funds from multiple investors.

Each strategy comes with its own requirements, risks, and potential returns.

Creating a Diversified Portfolio

Diversification involves investing in different types of properties and markets to spread risk. A well-diversified portfolio might include residential, commercial, and perhaps even international properties.

Evaluating Real Estate Markets and Locations

Researching Local Market Trends

Real estate markets can vary significantly from one location to another. Research local market trends to understand supply and demand dynamics, vacancy rates, and rental trends.

Analyzing Neighborhoods and Growth Potential

The neighborhood in which a property is located plays a crucial role in its investment potential. Look for neighborhoods with strong economic growth, low crime rates, good schools, and amenities.

Considering Economic Factors and Development Plans

Economic factors such as job growth, population growth, and infrastructure development can impact property values. Areas with new developments, such as transportation hubs or business districts, often experience increased demand for Invest in Real Estate.

Financing Your Real Estate Investment

Exploring Financing Options

Financing options include traditional mortgages, private loans, partnerships, and even using retirement funds for real estate investments. Each option has its own terms and requirements.

Calculating Return on Investment (ROI) and Cash Flow

ROI measures the profitability of an investment by comparing the initial cost to the expected returns. Positive cash flow occurs when rental income exceeds expenses, contributing to your overall ROI.

Budgeting for Initial Costs and Ongoing Expenses

In addition to the property's purchase price, budget for closing costs, property taxes, insurance, and potential repairs. Having a solid understanding of your expenses is vital for accurate financial planning.

Finding the Right Investment Property

Working with Real Estate Agents and Brokers

Real estate agents and brokers have valuable knowledge of the local market and can help you find properties that align with your investment goals.

Conducting Property Inspections and Due Diligence

Thoroughly inspect properties to identify potential issues that could affect their value or rental potential. Due diligence also involves reviewing property history and legal documentation.

Evaluating Property Value and Potential Appreciation

Property valuation requires understanding the local market and comparable property sales. Additionally, research factors that could contribute to future appreciation, such as upcoming developments or infrastructure improvements.

Negotiating Purchase and Closing the Deal

Making Competitive Offers and Negotiating Terms

Craft competitive offers that consider market value and the seller's motivations. Negotiate terms that work in your favor, such as a favorable closing date or repairs.

Reviewing Contracts and Legal Documentation

Ensure that all contractual terms are clearly defined and understood. Legal documentation includes the sales agreement, property title, and any contingencies.

Completing the Closing Process Smoothly

The closing process involves finalizing the transaction, transferring ownership, and addressing any outstanding issues. Work closely with your real estate professionals to ensure a smooth closing.

Property Management and Maintenance

Deciding Between Self-Management and Property Managers

You can choose to manage your property yourself or hire a property management company. Property managers handle tasks like tenant screening, rent collection, and maintenance.

Implementing Maintenance and Upkeep Strategies

Regular maintenance is essential for preserving your property's value. Implement a maintenance schedule and promptly address any repairs.

Ensuring Tenant Satisfaction and Retention

Happy tenants are more likely to stay longer, reducing turnover costs. Respond to tenant concerns and provide a well-maintained living environment.

Generating Rental Income

Setting Competitive Rental Rates

Research local rental rates to determine competitive pricing for your property. Balancing affordability with profit maximization is key.

Marketing and Attracting Reliable Tenants

Effective marketing strategies, such as online listings and professional photography, can attract quality tenants. Screen tenants thoroughly to minimize potential issues.

Implementing Lease Agreements and Rental Policies

Lease agreements outline the terms of the rental arrangement. Include important details like rent due dates, pet policies, and maintenance responsibilities.

Monitoring and Adapting Your Investment Strategy

Tracking Performance Metrics and Financial Health

Regularly monitor your property's performance, including income, expenses, and vacancy rates. Adjust your strategy based on this data.

Adjusting Strategies Based on Market Changes

Real estate markets are dynamic. Stay informed about market trends and adjust your strategy accordingly to remain competitive.

Leveraging Tax Benefits and Deductions

Consult a tax professional to maximize available tax benefits, such as deductions for mortgage interest and property-related expenses.

Exploring Advanced Real Estate Investment Strategies

House Hacking and Multifamily Properties

House hacking involves living in one unit of a multifamily property while renting out the others. This strategy can help cover your living expenses.

Real Estate Investment Trusts (REITs) and Crowdfunding

REITs allow you to invest in real estate without owning physical properties. Crowdfunding platforms pool funds from multiple investors to finance Invest in Real Estate projects.

Flipping Properties for Short-Term Gains

Property flipping involves purchasing distressed properties, renovating them, and selling them quickly for a profit. This strategy requires strong market knowledge and renovation skills.

Mitigating Risks and Challenges

Dealing with Vacancies and Tenant Turnover

Vacancies can impact your rental income. Have a strategy for quickly finding new tenants when a property becomes vacant.

Managing Unexpected Repairs and Emergencies

Budget for unexpected repairs and emergencies, such as a leaking roof or a broken water heater. Having a financial cushion can help you handle these situations.

Hedging Against Market Downturns

Market downturns can affect property values. A diverse portfolio, solid tenant relationships, and a long-term perspective can help you weather these challenges.

Scaling Your Real Estate Portfolio

Reinvesting Profits for Growth

As your portfolio grows, consider reinvesting profits into acquiring more properties. This can accelerate your wealth-building journey.

Expanding to Different Markets and Property Types

Diversifying your portfolio across different markets and property types can reduce risk and open up new growth opportunities.

Creating a Long-Term Wealth-Building Plan

Develop a comprehensive plan that outlines your investment goals, strategies, and anticipated milestones over the long term.

Legal and Tax Considerations

Understanding Property Ownership Structures

Property ownership can be held individually, jointly, or through legal entities like LLCs. Each structure has implications for liability and taxation.

Navigating Landlord-Tenant Laws and Regulations

Rental properties are subject to local and federal laws. Familiarize yourself with regulations related to tenant rights, eviction processes, and fair housing.

Maximizing Tax Efficiency and Minimizing Liabilities

Work with tax professionals to ensure that you're taking advantage of tax deductions and credits available to Invest in Real Estate.

Real Estate Investment Exit Strategies

Selling Properties for Profit

Selling a property can realize your gains, but it's important to time your sales strategically to maximize profits.

1031 Exchange: Deferring Capital Gains Tax

A 1031 exchange allows you to defer capital gains tax by reinvesting the proceeds from the sale of a property into a new property of equal or greater value.

Passing Down Real Estate Assets to Heirs

Estate planning allows you to pass down real estate assets to heirs. Proper planning can minimize tax implications and ensure a smooth transition.

Your Path to Financial Prosperity

Invest in real estate is a journey that requires careful planning, continuous learning, and a willingness to adapt to changing market conditions. By following these comprehensive guidelines, you're better equipped to make informed decisions that align with your financial aspirations. Whether you're looking to generate passive income, build equity, or achieve long-term wealth, the world of real estate investment offers a wealth of opportunities for those who are prepared to embark on this exciting path.

Investing in real estate is a multifaceted endeavor that requires a deep understanding of the market, a clear strategy, and careful execution. By following the steps outlined in this comprehensive guide, you can approach real estate investment with confidence and make well-informed decisions that align with your financial goals. Whether you're interested in rental properties, house flipping, or other real estate ventures, the key is to stay informed, remain adaptable, and leverage your knowledge to create a successful and profitable investment portfolio.

What's Your Reaction?